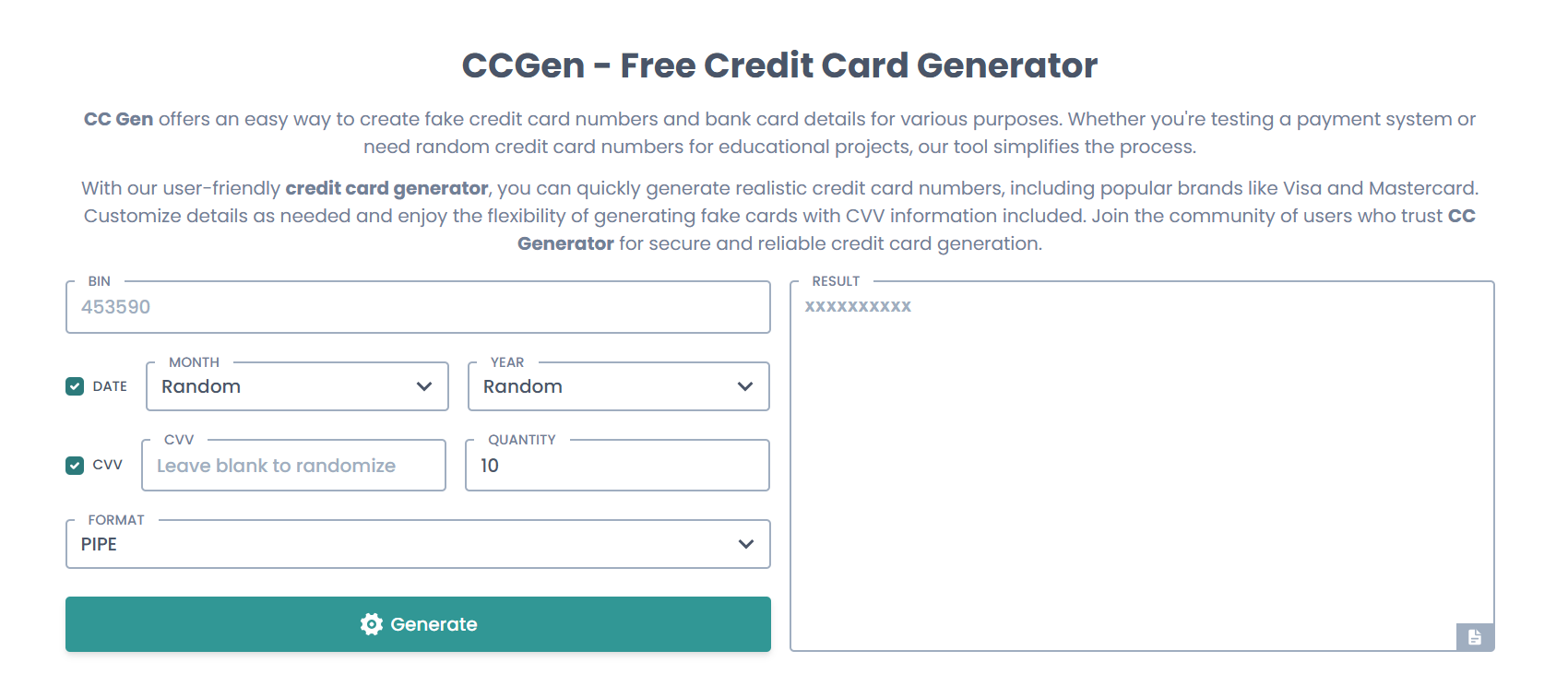

When testing payment systems or developing e-commerce platforms, having access to valid credit card numbers without risking real financial data is crucial. CCGen offers a free tool that generates fake but valid Visa and Mastercard numbers, designed to mimic real card formats while ensuring safety. These numbers help developers and testers simulate transactions in controlled environments.

CCGen’s generated numbers pass industry-standard checks like the Luhn algorithm, providing authenticity for testing purposes. With no registration or fees, CCGen offers quick and unlimited generation of Visa and Mastercard numbers aligned with 2025 standards. This makes it an essential resource for software professionals and educators alike.

This guide examines whether CCGen can generate valid Visa and Mastercard numbers, the technical details underlying this process, and how these numbers are utilized safely and effectively in real-world applications.

Valid Credit Card Number

Structural Components of Visa and Mastercard

Credit card numbers have specific structures, including issuer identification numbers, account numbers, and check digits. Visa cards typically start with “4,” while Mastercard uses prefixes like “51” to “55” or “2221” to “2720.” The length of these numbers usually ranges between 13 to 16 digits. Validity depends on matching these patterns.

The Role of the Luhn Algorithm

The Luhn algorithm is a checksum formula used to verify credit card numbers. It detects errors such as mistyped or invalid numbers through mathematical validation. A valid card number must pass this algorithmic check to be accepted by payment systems. This is a critical step in generating valid card numbers.

Why Validation Matters for Testing

Using numbers that pass validation checks is essential for simulating real transaction environments. Invalid numbers would be rejected instantly, making testing ineffective. Validity ensures payment gateways and e-commerce platforms handle inputs correctly under realistic conditions.

CCGen Creates Valid Visa Numbers

Visa Number Prefix and Length

CCGen generates Visa numbers starting with the digit “4,” which is the official issuer identifier. The generated numbers are between 13 and 16 digits long, adhering to Visa’s standards. This alignment ensures the numbers are structurally accurate for Visa testing.

Applying the Luhn Algorithm to Visa Numbers

After generating the initial digits, CCGen calculates the final check digit using the Luhn algorithm. This guarantees the number will pass validation tests performed by payment systems. The final output resembles a real Visa card number for authentic testing.

Use Cases for CCGen Visa Numbers

These generated Visa numbers can be used to test online payment forms, validate credit card processing software, and simulate transactions on e-commerce sites. They are invaluable for developers aiming to debug and optimize payment workflows safely.

CCGen Generates Valid Mastercard Numbers

Mastercard Prefix and Number Format

Mastercard numbers begin with prefixes ranging from “51” to “55” or “2221” to “2720” and are 16 digits in length. CCGen respects these specifications when generating numbers. This makes the numbers compatible with Mastercard’s network and accepted by relevant payment platforms.

Ensuring Mastercard Number Validity

The tool calculates the last digit of the card number using the Luhn checksum algorithm. This final digit confirms the structural integrity and validity of the number. Numbers that fail this check are discarded and regenerated to maintain accuracy.

Mastercard Numbers in Testing Scenarios

Developers use CCGen-generated Mastercard numbers to simulate purchase attempts, payment failures, and other transaction scenarios. These valid numbers help ensure that payment gateways behave as expected under different conditions.

CCGen Number Generation

Combining Randomness with Validation

CCGen generates random digits for the account number portion while keeping the issuer prefix fixed. It then uses the Luhn algorithm to compute the check digit, ensuring each number is unique yet valid. This blend maintains realism and usability.

Algorithmic Workflow

The system iteratively creates random numbers and tests them against the Luhn algorithm until valid ones are produced. This approach guarantees that only valid card numbers are presented to users. It maximizes test reliability and reduces false negatives.

Handling Different Card Specifications

CCGen is programmed to adjust the number length and prefix based on the selected card brand. This flexibility allows seamless generation of both Visa and Mastercard numbers following their respective rules. Future updates may add other card types.

CCGen for Valid Card Numbers

Risk-Free Testing Environment

By generating fake but valid numbers, CCGen allows developers to test software without risking exposure of real cardholder data. This enhances security and compliance with data protection laws. It eliminates concerns about financial fraud during development.

Cost Efficiency and Accessibility

CCGen offers free, instant generation without user registration, reducing barriers to quality test data. This accessibility benefits individual developers, startups, and large companies alike. Cost savings come from avoiding paid test card services.

Highlighting Key Benefits

- Generates valid Visa and Mastercard numbers

- No real financial data exposure

- Instant and unlimited free access

These benefits contribute to CCGen’s popularity among software testers and educators.

Practical Applications of CCGen Generated Numbers

Testing E-Commerce Payment Systems

E-commerce developers use CCGen-generated numbers to validate shopping cart checkouts, payment gateways, and refund processes. Valid numbers ensure these systems handle real-world transactions accurately. This testing helps avoid costly post-launch errors.

Educational and Training Tools

Financial educators and instructors use valid fake credit card numbers to teach students about payment systems and fraud detection. Hands-on experience with realistic data fosters a better understanding. CCGen supports this safe learning environment.

Common Use Cases

- Payment gateway integration testing

- Quality assurance for fintech apps

- Security and fraud system evaluations

These applications demonstrate CCGen’s versatility beyond simple number generation.

Limitations and Ethical Considerations

Limitations of Fake Card Numbers

Although CCGen generates structurally valid numbers, these cards are not linked to actual financial accounts. They cannot be used for real purchases or withdrawals. Users should avoid attempting real transactions with generated numbers.

Ethical Use of CCGen

Users must utilize generated numbers responsibly for testing, education, and research only. Misusing fake credit card numbers for fraud or deception is illegal and punishable by law. CCGen promotes ethical standards to protect all stakeholders.

Data Privacy and Security

CCGen does not collect or store personal data during number generation. This protects user privacy and prevents misuse. The platform ensures a safe environment free from financial risks or breaches.

Conclusion

CCGen successfully creates valid Visa and Mastercard numbers by combining fixed issuer prefixes with randomized digits and applying the Luhn algorithm. These numbers mimic real card formats closely enough to pass payment system validations, making them ideal for testing and education. The tool’s free, accessible design supports risk-free and cost-effective software development and learning. CCGen’s valid fake credit card numbers remain essential for realistic, secure payment simulations in 2025 and beyond.