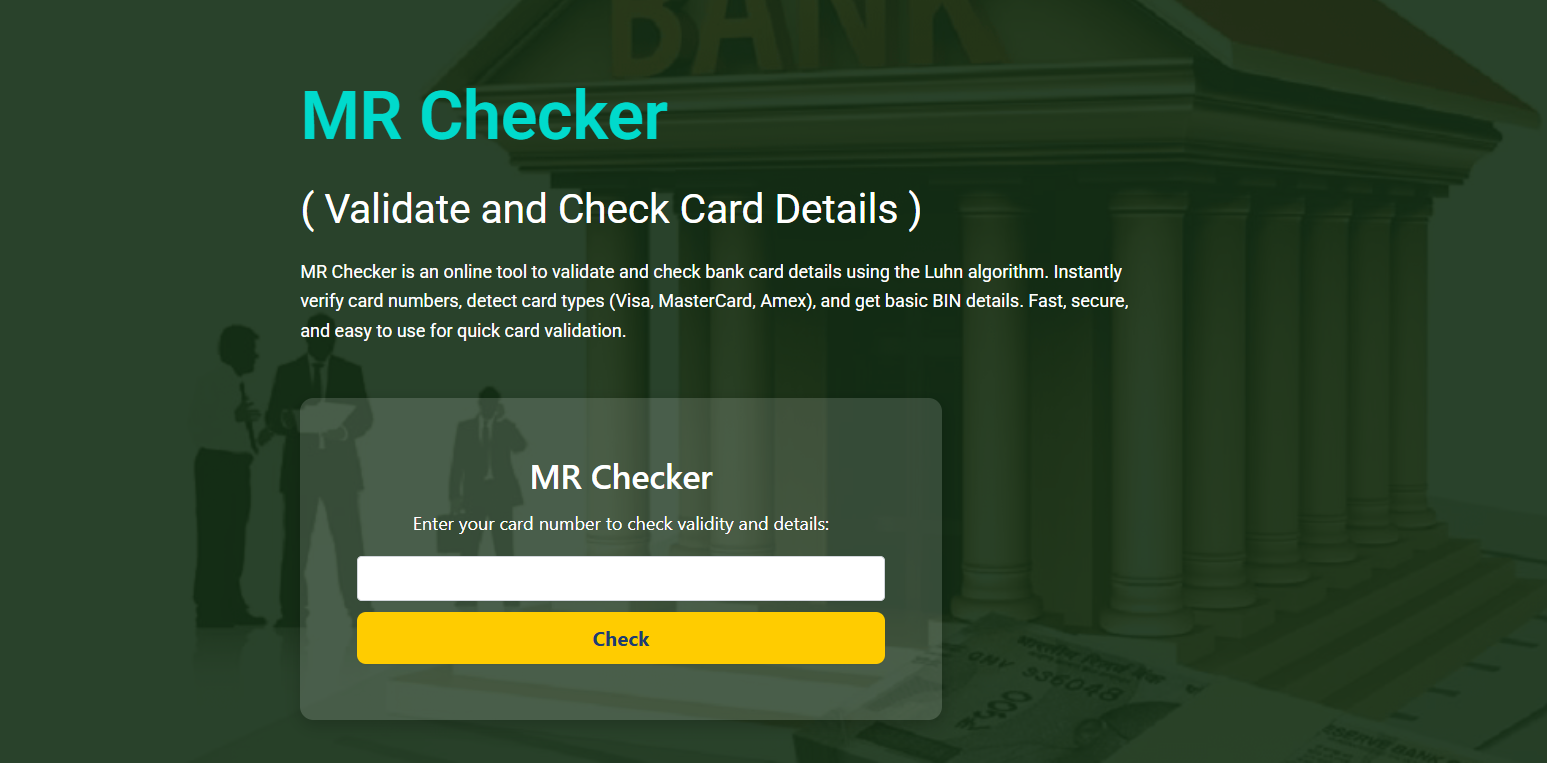

Validating a credit card online has become essential for developers, merchants, and security-conscious users. With digital transactions increasing, having a tool that instantly checks the legitimacy of a card number helps save time and prevent fraud. One such tool is MR Checker, a free and reliable solution that offers real-time card validation without requiring registration or technical setup.

Instant validation means checking whether a credit card number is structurally correct using logic-based algorithms. It doesn’t involve charging the card or accessing private data, but verifies if the number follows banking standards. MR Checker simplifies this process with a user-friendly interface and instant output.

Whether you’re testing a checkout page or verifying customer input, using a quick online validation tool ensures smooth operations. The process is straightforward, secure, and suitable for both technical and non-technical users alike. Here’s a detailed look into how online validation works and how MR Checker handles it efficiently.

Understanding Instant Validation

Structural Logic Behind Card Validation

Every valid credit card number follows a specific pattern defined by banking institutions. These patterns include issuer prefixes, fixed digit lengths, and a checksum digit. MR Checker uses the Luhn algorithm, which calculates the last digit based on the preceding numbers. This allows the tool to instantly identify if the input is formatted correctly.

By applying this logic, MR Checker confirms whether a card number passes the structural test. This is useful for weeding out mistyped entries or randomly generated numbers. It’s a smart and fast way to pre-screen data without risking sensitive information.

No Charges or Data Access Involved

Online validation doesn’t mean you’re performing a real transaction. Tools like MR Checker don’t interact with payment networks or financial institutions. Instead, they work locally or securely to check if the card number format is valid. No personal information is shared or stored during this process.

This distinction is important for privacy and compliance. MR Checker never requests sensitive details beyond the card number and offers a secure, client-side experience for quick, anonymous verification.

Accurate and Reliable Output

Accuracy in validation tools depends on how well they implement banking standards. MR Checker adheres to industry-approved formats and databases, ensuring reliable detection of card types and formats. It instantly returns results with no lag or delay, making it ideal for form testing or data entry scenarios.

Users can trust that the information provided is correct based on algorithmic validation and card structure logic. This eliminates confusion and improves user experience when working with digital payment fields.

Core Features of MR Checker

Free and Fast Validation Tool

MR Checker offers a completely free solution for instant card validation. Users simply enter a card number, and the system processes it within seconds. There’s no need to download software or create an account, which adds to its convenience. It works on desktop and mobile browsers alike.

Its fast response time makes it especially useful for developers and e-commerce site owners who want to verify card number inputs during testing. Even occasional users can benefit from its speed and simplicity.

Supports All Major Card Types

MR Checker identifies all major credit card providers. This includes Visa, MasterCard, American Express, Discover, and others. The tool uses BIN and prefix data to detect the brand instantly. This helps ensure that users are submitting compatible card types for any given system.

Identifying card brands also helps prevent mismatch errors. Businesses that only support specific card types can rely on MR Checker for initial input screening.

- Works with Visa, MasterCard, Amex, and more

- Validates format using the Luhn algorithm

- No need for financial data input

How Validation Works Technically

Using the Luhn Algorithm

The Luhn algorithm is a formula used to validate identification numbers, including credit card numbers. MR Checker applies this algorithm to determine if the number sequence is mathematically sound. The process involves doubling digits, summing them, and checking if the total ends in zero.

This doesn’t confirm if the card is active, but it filters out invalid entries quickly. It’s a proven, bank-approved method that ensures format-level integrity before any further processing.

BIN Lookup Functionality

The first 6 to 8 digits of a card number form the BIN, or Bank Identification Number. MR Checker uses this portion to identify the issuing bank, country, and card level (e.g., platinum, debit, credit). This adds another layer of useful information during validation.

With BIN data, businesses can identify high-risk cards or detect geographic inconsistencies. It’s a non-invasive method of gaining valuable insights from basic input.

Secure Client-Side Processing

MR Checker processes most requests on the client side, ensuring a private and secure experience. No card data is stored, transmitted, or exposed beyond the local validation check. This design adds a layer of privacy and ensures users can safely test or verify card numbers.

Security is a top concern, and MR Checker addresses it by avoiding back-end logging or third-party data sharing. It operates with a clear focus on confidentiality.

Use Cases for Online Card Validation

For Developers and Testers

Developers often need to test form validation during the creation of payment gateways or shopping carts. MR Checker makes it easy to confirm whether the front-end field logic is properly implemented. Using this tool during development helps reduce user input errors and boosts system readiness.

It’s also valuable during QA testing, where different card formats must be evaluated across various scenarios. MR Checker’s speed and accuracy improve testing workflows without reliance on payment APIs.

For E-Commerce Site Owners

Online retailers can use MR Checker to pre-screen customer-entered data. This avoids failed transactions due to incorrect card number input. The tool works well as part of a data-checking workflow, especially when dealing with international customers and varied card types.

It ensures fewer cart abandonments and provides an initial validation layer before passing data to payment processors.

For Fraud Detection Teams

BIN data and card type recognition can help flag suspicious activity. If a user from one region is submitting cards from a high-risk area, that might require extra scrutiny. MR Checker helps fraud teams collect these insights at an early stage.

This doesn’t replace full fraud prevention tools but acts as a low-cost layer in a larger risk mitigation strategy.

For Educators and Students

Learning about payment systems often involves understanding card structures. MR Checker serves as an educational resource for students and fintech learners. It’s a hands-on way to explore card prefixes, Luhn logic, and issuer behavior in real time.

It can also be used during technical courses or product training to show how input validation works in the real world.

- Simplifies fintech training and workshops

- No live data or APIs required

- Teaches real-world validation workflows

Advantages of Using MR Checker

Easy to Access and Use

MR Checker doesn’t require any technical background. Anyone with a browser can visit the site, input a card number, and get instant feedback. There’s no learning curve, which makes it suitable for a wide audience.

This simplicity means faster workflows, easier validation checks, and more reliable data inputs. It helps reduce guesswork and manual effort.

Compatible Across Devices

Whether you’re on a mobile phone, tablet, or desktop, MR Checker works smoothly. It’s optimized for different screen sizes and performs consistently across browsers. This flexibility supports on-the-go testing or validation, especially useful during live development.

Its responsive design ensures usability for a wide range of users, from casual checkers to professional testers.

100% Free to Use

MR Checker is a free tool, with no account required and no usage limits. Unlike other platforms that lock features behind paywalls, MR Checker gives full access to validation, card type detection, and BIN lookup without restrictions.

For businesses, students, and developers on a budget, this makes it an incredibly practical option.

- No hidden charges or subscriptions

- Unlimited validation checks

- Access to core features at no cost

Privacy and Security Considerations

No Data Storage or Logging

MR Checker doesn’t store or track card numbers. Once the validation is complete, the data is discarded. This ensures that users can test or verify numbers without fear of leakage or exposure.

Security-conscious users will appreciate that the tool doesn’t depend on servers that may log sensitive data. It stays within the bounds of ethical and compliant usage.

Built for Ethical Use

The platform is clearly intended for legitimate testing, education, and operational support. It discourages misuse by ensuring that no real financial information is processed. This keeps MR Checker compliant with best practices in the fintech and development communities.

By encouraging responsible use, MR Checker positions itself as a trustworthy resource in the online tools space.

Conclusion

Online credit card validation has never been easier thanks to tools like MR Checker. With instant feedback, card type detection, and secure processing, it’s the go-to choice for developers, merchants, and students. Quick access and reliable output make it a valuable resource for safe and effective card checks.